While New Jersey is on pace to add 48,600 nonagricultural jobs in 2013, that figure is 0.1 percent lower than last year’s total (49,100) and helps to explain while the state’s recovery rate is slower than the nation’s.

“Although our economy has improved the past two years, the speed of recovery in New Jersey has lagged the nation, Rutgers economist Nancy H. Mantell said today at the semiannual Rutgers Economic Advisory Service (R/ECON) subscriber conference. “As of February 2013, the country had regained two-thirds of the 8.75 million jobs lost during the recession, while New Jersey replaced only 43 percent of its quarter-million lost jobs.”

According to Mantell, on a month-over-same month previous year basis, after hitting bottom in January 2011, New Jersey experienced an employment gain of 42,000 jobs between January 2011 and January 2012, and another of 66,700 jobs between January 2012 and February 2013.

Hurricane Sandy’s impact was seen, in job terms, as a small loss of 600 jobs in November followed by a large gain of 24,500 jobs in December, Mantell said. “The only sector suffering a large negative impact from the storm seems to be leisure and hospitality, which lost 4,000 jobs in November,” she observed. “At the same time, there was a gain in the administrative and waste management sector as people went to work almost immediately on cleanup and repairs.

“The unanswerable question remains whether November’s loss would have been a gain without the storm,” she added.

Joining Mantell in discussing Sandy’s impact on New Jersey’s economy were PSE&G President and Chief Operating Officer Ralph LaRossa, who presented the utility’s perspective on the state’s power infrastructure, and Anne Strauss-Wieder, principal of the transportation, economic and strategy consultancy that bears her name, who summarized Sandy’s supply chain disruptions and offered an outlook for the transportation industry in the state. University Professor and economist Joseph J. Seneca and Dean James W. Hughes, both of Rutgers’ Edward J. Bloustein School of Planning and Public Policy, also were panelists.

As New Jersey continues its recovery, there has been a shift within the private sector as to where the jobs are, Mantell said. During the recession, about three-quarters of job losses occurred in manufacturing, construction, retail trade, financial activities, and professional and business services. “Those sectors account for about half the gains since the recovery began with most in professional and business services,” she noted, adding that the retail trade and service sectors have accounted for 80 percent of the net new jobs since January 2011.

“Over the course of the rest of the recovery and then expansion, we expect job growth in all sectors except manufacturing, information and utilities,” Mantell said. “The strongest rates of job growth will be seen in the four services sectors and construction, which will also see the largest numbers of job gains in the private sector.”

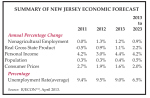

As the state’s recovery continues, employment growth will average 0.9 percent annually – 36,600 jobs – through the 2023 forecast period. The state will reach its 2008 employment peak in mid-2017, or three years after the same mark is achieved by the national economy. By the end of the forecast period, New Jersey’s employment base will be 234,000 jobs greater than the peak level of 4.09 million reached in January 2008.

As a result of the recession, New Jersey lost 4 percent of its gross output between 2008 and 2011. It is on track to regain that loss by 2014. The state’s unemployment rate will fall from its current (February 2013) level of 9.3 percent to 6 percent at the end of the forecast period. The rate of consumer inflation was 1.9 percent in 2012 and is expected to average 2 percent in the forecast period.

Low inflation, plus an average annual increase of 4.2 percent in personal income throughout the forecast, will give a boost to consumers’ buying power.

A copy of the April 2013 executive summary may be found here.